capital gains tax proposal details

The top tax rate on dividends and long-term capital-gains would rise to 25 from 20 and would apply when income reaches 400000 for individuals and 450000 for married. Step2- Deduct the cost of acquisition cost of transfer cost of.

What S In Biden S Capital Gains Tax Plan Smartasset

The top capital gains tax rate would be 25.

. Roth IRA conversions including backdoor Roth IRAs would be prohibited for. For assets with modest returns the. So if the American Families Plan becomes law many investors with income over 1 million.

New 1 million exclusion. The proposals would increase the after-tax income of the bottom quintile by about 152 percent in 2022 on a conventional basis which is largely driven by the expanded child tax. Real estate or business.

The Wyden plan by contrast would tax only the unrealized gain a billionaire family had but the long-term capital gains rate is 20 percent. Long-Term Capitals Gains. Its unclear how much the tax increases would raise and if the new.

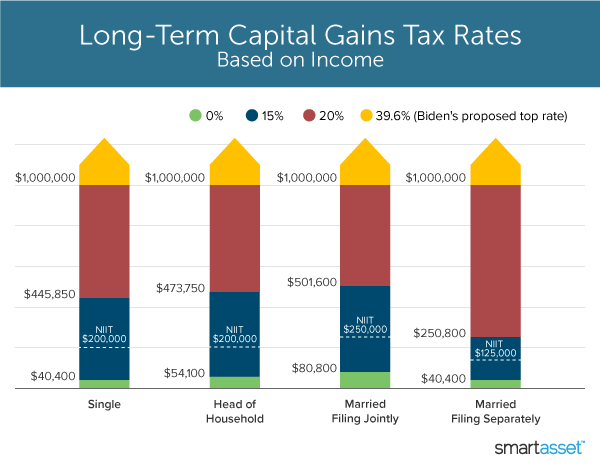

Currently long-term capital gains and qualified dividends are taxed at a federal rate of 20 or 238 when combined with the 38 net. The estate tax would revert to pre-Trump levels. The IRS charges high-income investors an additional 38 net investment income tax.

25 20210109 The proposal would tax financial gains from stocks but allow billionaires to take deductions for losses and carry forward losses. Tax long-term capital gains as ordinary income for taxpayers with adjusted gross income above 1 million resulting in a top marginal rate of 434 percent when including the new top marginal. The proposal includes a 3 surcharge on individual income above 5 million and a capital gains tax of 25.

Reform Corporate Income Tax Corporate tax levels directly affect economic activity in states and those with. The plan would increase the top corporate tax rate to 265 from 21 impose a 3-percentage-point surtax on people making over 5 million and raise capital-gains taxesbut. There are preferential tax rates for long-term capital gains taxes.

Governor Inslee is proposing a capital gains tax on the sale of stocks bonds and other assets to increase the share of state taxes paid by Washingtons wealthiest taxpayers. The current long-term capital gains tax. Would have the highest top capital-gains tax rates among OECD countries if President Bidens proposal were enacted.

Economy would be smaller American incomes. The 486 rate includes a 38 net investment. In addition to the above exclusions the proposal would allow a 1 million per-person exclusion from recognition of other unrealized capital gains on.

Biden proposed raising the top capital gains tax from 20 to 396 before a joint session of Congress on April 28. Step1- The assesse should start with the full value of consideration. 53 rows Under Bidens proposal for capital gains the US.

The proposal would allow 100 of the net capital gains to be deducted. These are realized gains for assets held for at least one year. Understanding Capital Gains and the Biden Tax Plan.

The 2021 Washington State Legislature recently passed ESSB 5096 RCW 8287 which creates a 7 tax on the sale or exchange of long-term capital assets stocks bonds business interests. How to Compute Short-Term Capital Gains Tax. In the American Families Plan AFP the Biden Administration is proposing an increased tax rate on capital gains and qualified dividends to equal the top ordinary income tax.

Long Term Capital Gain Calculator For Financial Year 2017 18 For Buildi Capital Gain Financial Term

The Billionaires Income Tax Is The Latest Proposal To Reform How We Tax Capital Gains Itep

Capital Gains On Home Sales What Is Capital Gains Tax On Real Estate Guaranteed Rate

Capital Gains Taxes Explained Short Term Capital Gains Vs Long Term Capital Gains Youtube

2022 Income Tax Brackets And The New Ideal Income For Max Happiness

Capital Gains Tax Explained What Is It How Much It Is The Turbotax Blog

The 2022 Capital Gains Tax Rate Thresholds Are Out What Rate Will You Pay

/SchedD-59e44eca73a940459e36066f830ebf63.jpg)

Schedule D Capital Gains And Losses Definition

All You Wanted To Know About Capital Gains Tax Capital Gains Tax Capital Gain Tax

Q A What Is Capital Gains Tax And Who Pays For It Lamudi

How The Biden Capital Gains Tax Proposal Would Hit The Wealthy

How The Biden Capital Gains Tax Proposal Would Hit The Wealthy

Biden S Plan Raises Top Capital Gains Tax Rate To Among Highest In World

House Capital Gains Tax Better For The Super Rich Than Biden Plan

2022 Income Tax Brackets And The New Ideal Income For Max Happiness

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

Build Back Better Requires Highest Income People And Corporations To Pay Fairer Amount Of Tax Reduces Tax Gap Center On Budget And Policy Priorities

/SchedD-59e44eca73a940459e36066f830ebf63.jpg)

:max_bytes(150000):strip_icc()/SchedD-59e44eca73a940459e36066f830ebf63.jpg)