price to cash flow from assets formula

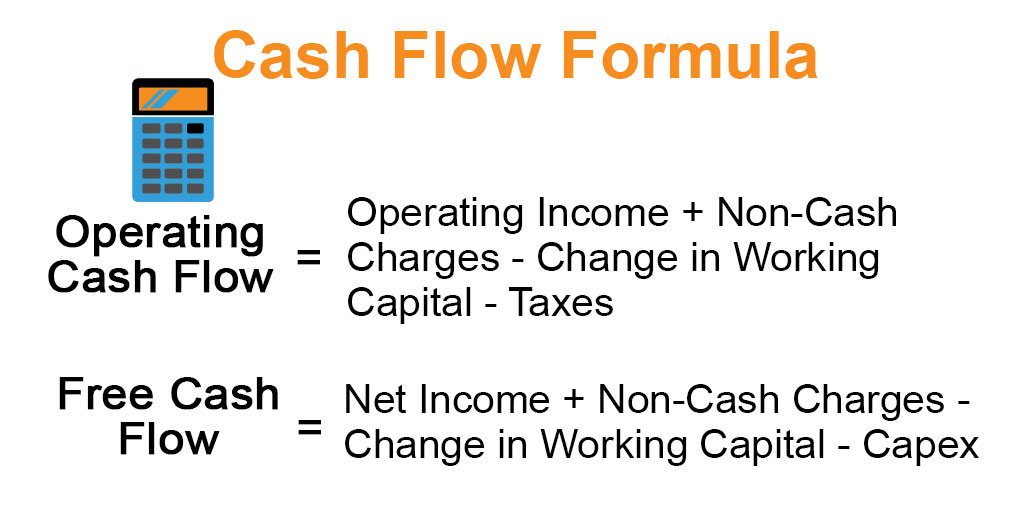

Redesign products to reduce materials costs. Operating Cash Flow can be calculated using the following formula.

Cash Flow From Investing Activities Accounting Small Business Accounting Accounting Education

You can be a profitable company but if you dont have cash moving around to pay bills then you are really in trouble.

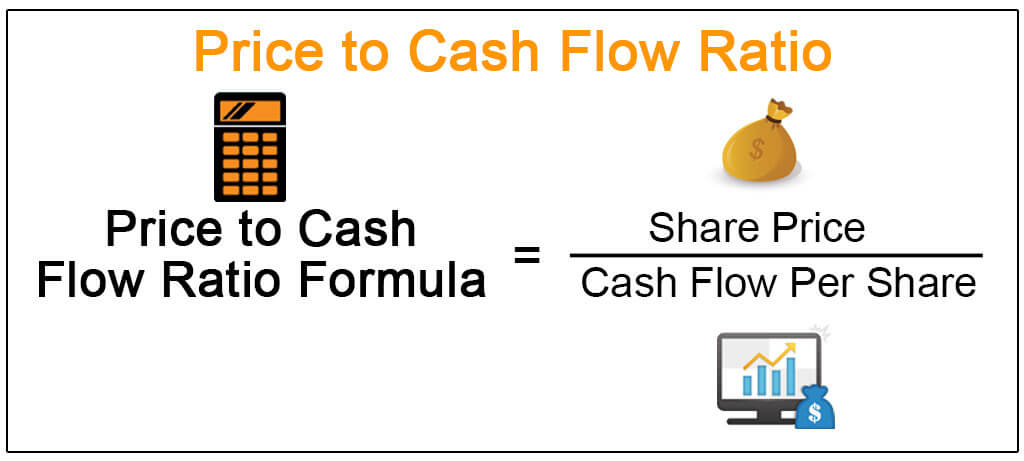

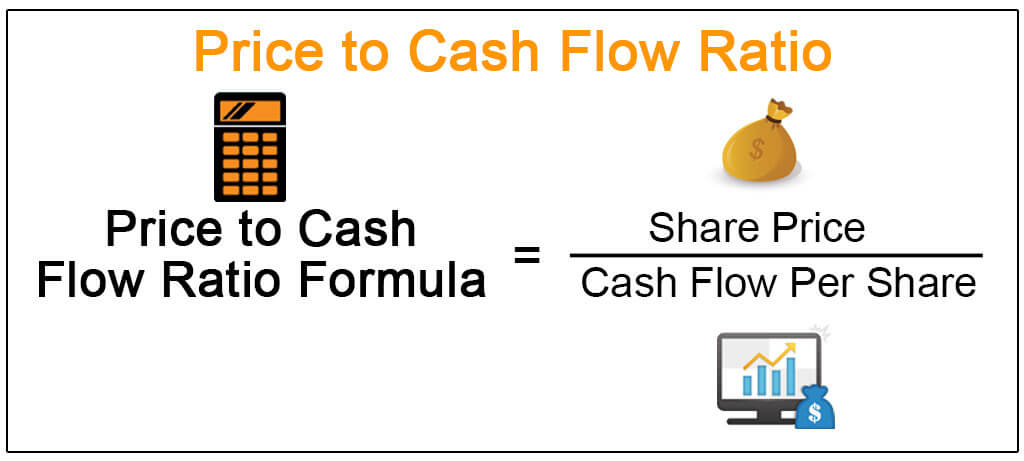

. The price-to-cash-flow ratio takes the current share price and divides it by the total cash flow from operations. The generic Free Cash Flow FCF Formula is equal to Cash from Operations minus Capital Expenditures. Since this ratio takes the companys operating cash flow into account its also known as the price to operating cash.

Example of Cash Returns on Asset Ratio. In case of Frost we need to estimate operating cash flows and then work out PCF as follows. Please note that the PCF that we earlier saw for Chevron 1601x is the trailing twelve month Price to Cash Flow.

PCF 2015 115601031 1120x. -10000 Fixed assets -10000 fixed asset purchases -23000 Cash flow from assets. A cash flow multiple of 5 means that the company is worth 5x its cash flow.

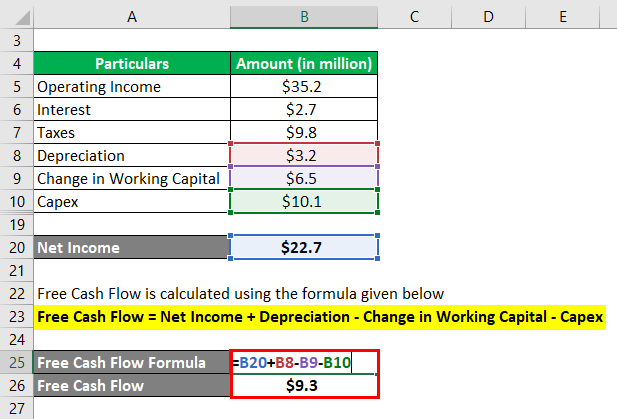

Operating Cash Flow Operating Income Depreciation Taxes Change in Working Capital. Example of the Price to Cash Flows Formula. Operating cash flow formula.

Remember that the cash flows to total assets ratio has nothing to do with income or profitability. Cash Flows from Operations. OCF Net Income Depreciation Amortization Change in WC Any other non-cash item.

An example of calculating the price to cash flows would be to assume that a company has a market cap of 500 million. Cash Flow Per Share 2015 1031. The Price to Cash Flow ratio formula is calculated by dividing the share amount by the operating cash flow per share.

If a company has an operating income of 30000 5000 in taxes zero depreciation and 19000 working capital its operating. The statement of cash flows shows. DA deductions for depreciation and amortization.

It only has to do with the efficiency of. This cash flow is passed on to the investors as dividend. Chevron Price to Cash Flow 2015.

Price to Cash Flow Share Price. Due to this factor every valuation metrics such as PCF needs to be time stamped. Share Price or Market Cap is amount that a share of asset is traded at on the open marketplace.

The CF or cash flow found in the denominator of the ratio is obtained through a calculation of the trailing 12-month cash flows generated by. Cash returns on assets cash flow from operations Total assets. This uses free cash flow instead of total cash flow from operations.

Cash Flow From Operations provides a measurement of cash inflows and outflows for a specific period of time usually quarterly or annually. Firstly determine the net income of the company from the income. The higher the ratio the more efficient the business is.

The cash flows to total assets ratio shows investors how efficiently the business is at using its assets to collect cash from sales and customers. The number you receive when using this formula is called a cash flow multiple. T the amount of income tax.

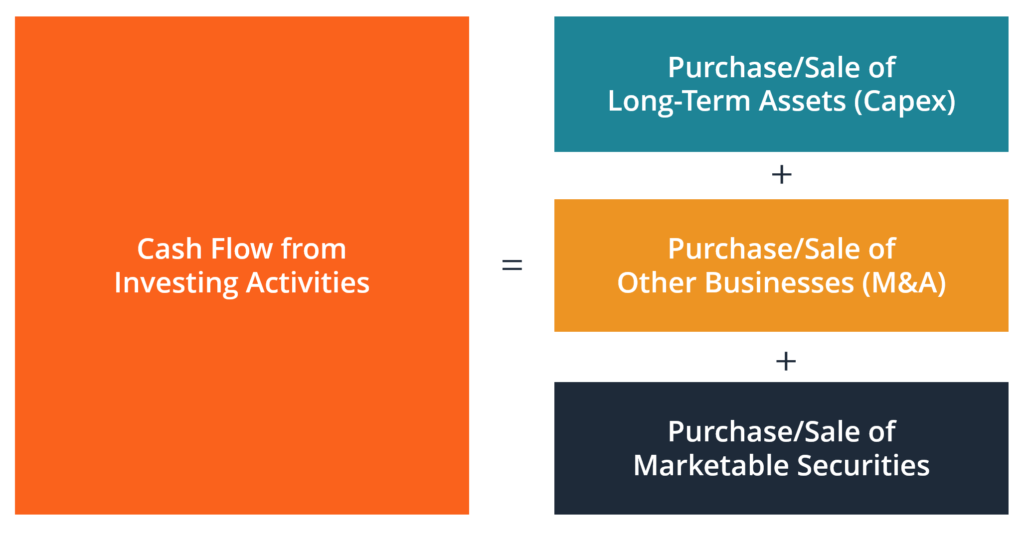

Management can generate positive cash flow from assets by using a variety of techniques including the following. The profit and loss statement does not always line up with the cash flow statement. The cash flow statement defines three types of cash flow.

Knowing your cash flow from operations is a must when getting an accurate overview of your cash flow. Cash flow from Operations 2015 19456 million. Shouldnt run into any problems.

Cash Returns on Asset Ratio 5. 500000 100000. If this information wasnt readily available an individual could calculate this based on a share price of 2500 with 20 million shares outstanding.

Thus if the price to cash flow ratio is 3 then the investors are paying 3 rupees for a stream of future cash flows of 1 rupee each. Lets consider the example of an automaker with the following financials. How to Create Positive Cash Flow.

50 15. Due to this factor every valuation metrics such as PCF needs to be time stamped. OCF EBIT DA-T where.

The price to cash flow ratio tells the investor the number of rupees that they are paying for every rupee in cash flow that the company earns. Operating Cash Flow Operating Income Non-Cash Charges Change in Working Capital Taxes. These 3 types of cash flow totaled equal Total Cash Flow.

A ratio of 030 30 is quite good Corys Tequila Co. Current Stock Price Cash Flow per Share. Net Income.

EBIT profit from the main activity ie the amount of the companys profit before taxes and interest. Cash flow is often overlooked when people analyze a company. This is operating cash flow formula.

Some prefer to use a modified price-to-cash-flow ratio. Cut overhead to reduce operating costs. This figure is also sometimes compared to Free Cash Flow to Equity or Free Cash Flow to the Firm.

Cash flow from operations cash flow from investing activities and cash flow from financing. Share Price or Market Cap is price that a share of stock is traded at on the open market. Thats because the FCF formula doesnt account for.

Operating cash flow formula is represented the following way. FCF represents the amount of cash generated by a business after accounting for reinvestment in non-current capital assets by the company. The formula for free cash flow can be derived by using the following steps.

While free cash flow gives you a good idea of the cash available to reinvest in the business it doesnt always show the most accurate picture of your normal everyday cash flow. In other words for every 5 of cash flow the company is worth 1. Price to Cash flow Ratio.

Number of Shares in 2015 1886 million. It relates a companys ability to generate cash compared to its asset size. It means that the automaker generates a cash flow of 5 on every 1 of its assets.

Price To Cash Flow Ratio P Cf Formula And Calculation

Cash Flow Ratios Cash Flow Flow Cash

Myeducator Accounting Education Business Management Degree Accounting Classes

Definition Of Ebitda Cash Flow Statement Financial Analysis Accounting Notes

Cash Flow From Investing Activities Overview Example What S Included

Advantages Of Free Cash Flow Cash Flow Lower Debt Free Cash

Price To Cash Flow Formula Example Calculate P Cf Ratio

Common Financial Accounting Ratios Formulas Financial Analysis Accounting Small Business Resources

Statement Cash Flows Powerpoint Diagrams Cash Flow Cash Flow Statement Business Powerpoint Templates

Cash Flow Formula How To Calculate Cash Flow With Examples

Small Business Accounting Archives Mirex Marketing Small Business Accounting Accounting Bookkeeping Business

Cash Flow Formula How To Calculate Cash Flow With Examples Cash Flow Positive Cash Flow Formula

Formula For Cash Flow Bookkeeping Business Economics Lessons Accounting Education

Cash Flow Ratios Calculator Double Entry Bookkeeping Cash Flow Statement Cash Flow Learn Accounting

What Does Price To Cash Flow Indicate Positive Cash Flow Cash Flow Financial Analysis

Cash Flow From Operating Activities Accounting Education Learn Accounting Cash Flow

Financial Ratios Statement Of Cash Flows Accountingcoach Financial Ratio Cash Flow Statement Financial

Book Value Can Mean Various Things To Various People For Instance Book Value On The Invest Pedia Blog At The Time Of Book Value Meant To Be Accounting Books